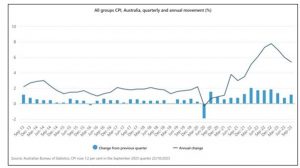

Last week, the Australian Bureau of Statistics (ABS) revealed that the Australian Consumer Price Index (CPI) rose 1.2% in the September 2023 quarter – significantly higher than the 0.8 per cent rise recorded in the June 2023 quarter.

Importantly, the September 2023 Quarter rise continued to be lower than all of the quarterly rises seen throughout 2022 (See Figure 1) and the annual inflation rate – as opposed to the quarterly one – dropped from 6% at the end of the June 2023 Quarter, to 5.4% in the September 2023 Quarter.

Figure 1: Despite being higher than the June 2023 Quarter, the September 2023 CPI rise was below all quarterly rises recording during 2022. Source: CPI rose 1.2 per cent in the September 2023 quarter | Australian Bureau of Statistics (abs.gov.au).

Figure 1: Despite being higher than the June 2023 Quarter, the September 2023 CPI rise was below all quarterly rises recording during 2022. Source: CPI rose 1.2 per cent in the September 2023 quarter | Australian Bureau of Statistics (abs.gov.au).

The accompanying CPI commentary put out by the ABS stated that the most significant contributors to the rise in the September quarter were automotive fuel (+7.2 %), rents (+2.2%), new dwellings purchased by owner occupiers (+1.3%) and electricity (+4.2%).

“Needless to say that the release of the CPI figures on Monday highlighting that fuel prices were one of the ‘most significant’ contributors to the CPI rise in the September Quarter resulted in a renewed round of media inquiry about average petrol and diesel prices this week”, said ACAPMA CEO Mark McKenzie.

“A number of media outlets were quick to paint a relatively bleak picture about future fuel prices by combining the CPI announcement with commodity market commentary suggesting that the Middle East conflict will ‘inevitably’ lead to a sharp rise in oil and fuel prices by Christmas”.

While this renewed media and community interest in petrol prices is understandable given wider cost of living concerns in Australia, recent developments do not mean that a further sharp rise in fuel prices is ‘inevitable’.

In fact, Australian terminal gate prices appear to have eased slightly over the past month on the back of falling MOGAS95 and GASOIL prices and this has been reflected in a slight reduction in average petrol and diesel prices across Australia.

Further, and notwithstanding the horrible impact of the unfolding human tragedy in the Middle East, the impact of new hostilities in the Middle East has not had a material impact on global oil prices. Not yet anyway.

As with any commentary about future oil and fuel prices, it is near impossible to predict exactly what might happen next. But there are a few facts that may help in assessing the likely magnitude of further fuel prices in Australia – and its impact on Australia’s CPI – as we approach the end of the 2023 calendar year.

- Oil Prices are not rising sharply – at least not yet

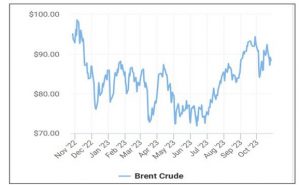

Despite repeated suggestions that global oil prices would immediately push past the US$100 per barrel mark immediately following the breakout of the Middle East conflict on 7 October 2023, oil prices have continued to bounce around between the US$85bbl and $95bbl over the past few weeks.

While many commentators suggested that a widening conflict in the Middle East would likely have the same impact on oil prices as occurred following the commencement of the Russia-Ukraine conflict, there are two factors that suggest such an observation is not necessarily true. One is a ‘supply side’ factor and the other is a ‘demand side’ factor.

The first factor is associated with the potential reduction of global supply due to a possible future boycott of Iranian oil exports, as occurred when many Western Economies boycotted Russion oil supplies last year. But at an estimated contribution of just 1% to global oil exports, the loss of Iranian oil supply represents just one tenth of the supply risk that occurred as a result of the loss of Russia’s 10% contribution last year.

The second relates to key differences in the near-term outlook for global oil demand today versus 12 months ago. When hostilities broke out in Ukraine in late February 2022, the world was recovering from a global lockdown. International air travel resumed, and many economies were increasing replenishing national fuel reserves in the wake of a significant depletion during the Covid years.

Fast forward to today and much of the global economic conversation suggests a likely lessening of global oil demand due to an anticipated slowdown of the global economy.

Couple this near-term economic outlook with information from the International Energy Agency (IEA) this week suggesting that global oil demand will likely peak at 102 Million barrels per day by the end of this decade (before falling by 5% to around 97 Million barrels per day by the middle of the century), there is reason to believe that falling demand associated with a declining global economy will likely put downward pressure on average oil prices in the short to medium term.

While these two factors don’t necessarily mean that oil prices will go down instead of up, it is equally untrue to suggest that current world events mean that oil and fuel prices will ‘inevitably’ rise sharply.

“Put simply, the fundamentals of the global supply-demand relationship for oil and oil products over the near-term are a bit of a ‘mixed bag’”, said Mark.

What is more, and contrary to the predictions that oil prices would rise sharply in recent weeks given the Middle-East conflict, oil prices have fallen since the end of September 2023 and remain lower than the oil price highs experienced in November of last year (see Figure 2).

Figure 2: Global oil prices (Futures) have fallen in the past month and are lower than this time 12 months ago. (Source: Oil Price Charts | Oilprice.com).

Figure 2: Global oil prices (Futures) have fallen in the past month and are lower than this time 12 months ago. (Source: Oil Price Charts | Oilprice.com).

2. The refined price of petrol and diesel has eased slightly.

While much has been made about the impact of global oil price movements on average Australian fuel retail prices of late, the real story has been the increased volatility of refined product prices. This factor appears to have been a very significant contributor to the increase in average fuel prices experienced in Australia during the September 2023 Quarter.

The impact of sharp rises in refined product prices is particularly evident when you consider that the current average wholesale price (and average retail price) of fuels in Australia are higher than in November last year, despite oil prices being lower now than they were in November of last year.

Global fuel industry commentators have suggested that finished fuel prices have become far more volatile since Covid owing to a ‘trimming’ of global refinery asset base. This, together with a number of unplanned refinery outages in Asia and the Middle East, is likely to have contributed to a short-term supply squeeze during July and August 2023 – resulting in an increase in petrol and diesel prices in our Region.

Industry analysts have suggested that the sharp downturn in fuel demand experienced during the Covid years of 2020 and 2021 resulted in a number of older/marginal refineries being ‘mothballed’ during Covid – and subsequently closed permanently. This, some analysts suggest, has had the effect of reducing global production capacity for finished fuel products, resulting in greater volatility in the trading of finished fuel products in the wake of changing demand.

This increased volatility of finished fuel products is evidenced by the extreme movement in global refining premiums for MOGAS95 (i.e. Singapore benchmark price) as shown in Figure 3 below.

Figure 3: The Global Refinery Premium for finished product prices has been extremely volatile since Covid and has arguably had a bigger impact on Australian petrol prices than oil price movements during the September 2023 Quarter. (Source: Weekly Petrol Prices Report – 22 October 2023.pdf (aip.com.au)).

Figure 3: The Global Refinery Premium for finished product prices has been extremely volatile since Covid and has arguably had a bigger impact on Australian petrol prices than oil price movements during the September 2023 Quarter. (Source: Weekly Petrol Prices Report – 22 October 2023.pdf (aip.com.au)).

Interestingly, the refined product price (ex-Singapore) for petrol has dropped by almost 20cpl since the peak in August 2023. While this fall will not necessarily be maintained in the future, there is a possibility that if it is maintained then it will serve to largely offset the impact of any near-term rise in the global cost of oil on average pump prices in Australia.

The ultimate effect of changes in finished product prices during the next quarter will ultimately be impacted by any further changes in the $AUD to $USD exchange rate, with the recent fall in the value of the Australian dollar also being a significant factor in the fuel price rise experienced during the September 2023 Quarter in Australia.

3. The contribution of petrol prices to Australia’s CPI is both volatile and relatively small.

Fuel prices are one of the consumer prices used by the ABS to calculate Australia’s Consumer Price Index (or CPI) which, in turn, is used to provide a measure of Australia’s annual inflation rate. Typically, the ABS cites two indicators – a quarterly indicator of price movement (or month to month between Quarterly Reports) and an annual indicator of price movement.

As discussed earlier, the rolling annual inflation rate to the end of the September Quarter actually fell from 6% to 5.4% but concern was expressed by the growth in the quarterly inflation rate which increased from 0.8% in the June Quarter to 1.2%.

The identification of petrol prices as a key reason for the quarterly increase resulted in a flurry of media commentary about the future impact of further increases in global oil prices on Australia’s average fuel prices – and hence Australia’s inflation rate.

Yet it is worth noting two things about the contribution of fuel prices to the calculation of Australia’s CPI.

First, fuel prices are volatile and can have a very different impact on the calculation of CPI when considered on a ‘quarter by quarter basis’. At the end of the June 2023 Quarter, for example, average fuel prices actually declined by 3.6% and therefore placed a slight downward pressure on Australia’s inflation rate that was countered by larger increases in average food costs and accommodation costs.

Just 3 months on, at the end of the September 2023 Quarter, the ABS reported that fuel prices increased by 7.2% and therefore had contributed to a general rise in Australia’s CPI.

The second point to note is that while there is a lot of attention on the link between fuel prices and inflation because it is a cost that cannot easily be avoided by Australian consumers, the contribution of average fuel prices to the calculation of the CPI is relatively small at just 3.5%.

So, what does it all mean in the end?

Put simply, and contrary to some very bleak predictions about the ‘almost certain’ rise in fuel prices and Australia’s CPI, some facts suggest a possible alternative outcome of prices remaining steady or even falling slightly.

“The reality is that there are a series of demand-side and supply side factors, coupled with global industry developments and geopolitical influences, which are making it more difficult than ever to predict the future movement of Australia’s average retail fuel prices”, said Mark.

“While there are certainly some key factors putting upward pressure on global oil prices (and hence) national fuel prices, there are also other factors that are likely to put downward pressure on prices”.

“The consequent impact of the interplay between these two sets of factors on future of average fuel prices in Australia is therefore anyone’s guess. But one thing is for sure, the suggestion that sharp rises in fuel prices for Australian consumers are ‘inevitable’ by Christmas is just plain wrong. Further rises are possible but not ‘inevitable’”, concluded Mark.

ACAPMA