GapMaps, a cloud-based location intelligence platform, has released its annual ‘Fast Food & Quick Service Restaurant’ (QSR) report, which provides valuable insights on the number of store openings and closures in Australia for the year ending 30 June.

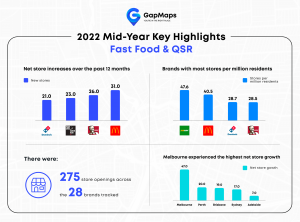

Tracking 28 brands in 6734 locations, the report shows 275 stores opened and 118 stores closed across the 12-month period.

“In the reporting period we saw strong overall growth with a net increase of 157 new stores after taking into account openings and closures we’ve observed over the past 12 months,” says GapMaps Senior Analyst Scott Johnson.

McDonald’s led in terms of new store openings with 31, followed by KFC (26), Subway (25), Sushi Hub (23), Dominos (21) and Zambrero (16).

McDonald’s led in terms of new store openings with 31, followed by KFC (26), Subway (25), Sushi Hub (23), Dominos (21) and Zambrero (16).

The last quarter (April-June) yielded 60 new store openings with activity led by Dominos (13), Guzman Y Gomez (nine) and Sushi Sushi (five). The same period saw 30 closures, of which Subway and Mad Mex reported five each.

Over the full year, Subway reported 41 store closures, which resulted in net -16 over the 12-month period, followed by Nando’s (15), Pizza Hut (12) and Zambrero (eight).

On a per city level, Melbourne posted the most net store growth over 12 months with 47, followed by Perth with 20, Brisbane with 19 and Sydney with 17. Brands with the most stores per million residents are Subway (47.6), McDonald’s (40.5), Dominos (28.7), and KFC (28.5).

In addition to Fast Food and QSR, GapMaps also released full year reports on petrol retail, health & fitness, childcare, auto tyres & servicing, and cafe.

Key findings include:

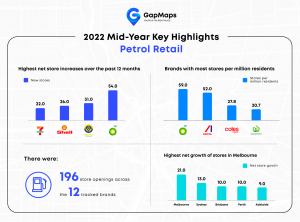

- 12 brands tracked over 6699 locations with 196 openings and 64 closures. BP Australia added 54 locations, followed by Metro Petroleum (37), Shell (28), 7-Eleven Fuel (24) and Ampol Australia (20).

- Looking at closures, Ampol Caltex accounted for more than half with 34, followed by Coles Express with nine, Woolworths Petrol Plus with seven and Metro Petroleum with six.

- The petrol retail sector has a large store footprint on highways away from populated centres, with only Shell and 7-Eleven Fuel stores seeing 50 per cent or more of their growth in tier one (major metropolitan) areas.

- The final quarter showed modest movements, with just 33 openings and five closures.

Cafe

Cafe

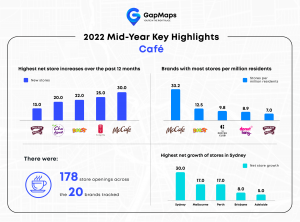

- The cafe sector expanded with a net increase of 95 stores across Australia. Notable expansions were McDonalds (McCafe) and Gong Cha, adding 30 and 25 stores respectively, and Boost Juice (22).

- The Coffee Club saw a reconfiguring of its network, closing the most stores (13), but also opening 12 other stores across Australia.

- Most openings and closures occurred in tier one (metro) locations with highest net store growth in Sydney (30), Melbourne (17) and Perth (17). Outside McDonalds’ large presence of McCafe stores in metro and regional cities, the Coffee Club’s provisions of 23.4 and 33.9 stores per million residents in Greater Brisbane and Sunshine coast were a notable strength compared to its average provision of 9.8.

“Each of our reports provide brands with unique insights and key trends into the changing competitor landscape in their respective retail sectors,” Mr Johnson said.

“Our ability to use a range of data points to represent the most up-to-date view of physical network locations is helping brands make better location decisions at a time when new working arrangements, such as hybrid, is having an impact on population habits and movements.”