During his Budget speech on Tuesday 29 March 2022, the then Federal Treasurer (the Hon. Josh Frydenberg MP) announced that the Federal fuel excise would be halved from midnight on 30 March 2022 for a period of six months. The measure was designed to provide cost-of-living relief to motorists in the wake of a sharp increase in global oil and fuel prices, resulting in the fuel excise rate being reduced from 44.2cpl to 22.1cpl.

The measure was welcomed by most and received the bi-partisan support of the Australian Parliament. There was, however, criticism from the road freight industry because the legislation did not allow the continued application of the 17.8cpl Fuel Tax Credit (FTC) for road freight business to the discounted excise rate. Effectively, this meant that the rate of fuel tax paid by the road freight industry decreased by just 4.3cpl compared with the 22.1cpl discount provided to Australian motorists.

“The most unfortunate aspect of the decision to lower fuel excise was the fact that there had been no consultation with industry, effectively catching both the Australian fuel industry and the road freight industry by surprise”, said ACAPMA CEO Mark McKenzie.

In the 24 hours following the announcement, one of the big national retail networks chose to pass on 50% of the excise cut immediately – and then passed through the remainder just 24 hours later. Many of the other capital city fuel retailers, in their quest to remain price competitive, elected to match these cuts. As a result, most of the nation’s fuel retailers – particularly those in the large capital cities where market competition is the most intense – lowered their prices almost immediately and lost money during the early days of the excise transition.

“I remember doing an interview with 3AW in Melbourne where radio announcer Neil Mitchell asked me why the price had gone down so fast given that I had spoken with him just days earlier suggesting that it would likely be five to seven days before the higher excise fuel was replaced – and average fuel retail prices reflected the full excise cut”, said Mark.

“Suffice to say, the competitive dynamic meant that motorists got the benefits of a lower fuel price much faster than might reasonably have been expected given the large amount of fuel that had already flowed past the excise point at the time the decision to cut excise was made.”

The ACCC monitored the transition closely, declaring that the lower excise was evident in the retail fuel prices being levied by the majority of the nation’s 7600 service stations two weeks after the excise cut had been announced. The ACCC also noted, however, that there were around 775 retail sites that had apparently not yet passed through the full excise cut – albeit that the vast majority of these were in rural areas where fuel turnover was much slower than metropolitan areas.

In its’ June Quarterly Report (June Quarter 2022 Petrol Report.pdf (accc.gov.au)) the ACCC stated “Our analysis noted significant falls in retail fuel prices in most locations in the first 6weeks after the cuts, indicating that the excise cuts had clearly been passed on to a large extent. There were a relatively small number of locations in regional areas where the decreases in petrol and diesel prices were smaller than the cut in excise”.

“In short, and following increased fuel market price surveillance as requested by the former Morrison Government, our industry was observed to have passed through the full excise in a timely way – save for a handful of the nation’s 7600 service stations”, said Mark.

Even more significantly, the ACCC noted (also in its June 2022 Quarterly Report) that the cumulative difference between the wholesale and retail prices during May and June 2022 was lower than the historical average for 63% of the 180 locations (i.e. eight capital cities and 172 regional locations) investigated in the period following the excise cut.

“The fact that the gross indicative retail difference (that is, the difference between average wholesale and average retail prices) had fallen was not news to fuel businesses, as the June 2022 quarter trading period has been one of the most difficult in recent memory in terms of both gross profit and cashflow management”, said Mark.

Now, as the Government prepares to restore full fuel excise, fuel retail businesses are again being publicly ‘warned’ about ensuring retail fuel prices increase in line with changes in wholesale prices.

Specifically, the new Federal Treasurer (the Hon. Jim Chalmers MP) publicly stated that he “did not expect fuel prices to rise at the pump immediately, given the significant volume of lower excise fuel that would be in the system at the time of the excise change”.

While acknowledging that there is typically around five days cover – equivalent to an estimated 700 million litres – in the wholesale and retail networks at any given point in time, ACAPMA has stressed to both the Treasurer’s office and media outlets that service stations have different delivery schedules. As a result, many retailers in metropolitan areas will likely receive deliveries of the higher excise fuel the day that the higher fuel excise comes into effect.

How these retailers ultimately price their higher excise fuel in the period following the excise cut will come down to individual business decisions in the face of the fierce competitive dynamic that exists in the Australian fuel retail market.

“Individual fuel businesses may choose to immediately pass on all of the higher wholesale cost; or they may choose only to pass on part of it; or they may forego the increase altogether to remain price competitive against their competitors who still have stocks of lower excise fuel in the ground”, said Mark.

The ACCC has similarly weighed in with public comment about their expectations of retail fuel market behaviour as the fuel excise is returned to the full rate next week.

The ACCC has suggested that there was an ‘average’ six-week lag among fuel retailers between when the excise relief was introduced and when that flowed on to cheaper fuel at the bowser, as retailers worked through existing stock bought at higher prices. The Commission went on to say that they expected a ‘similar lag’ when the higher excise returns and would be watching closely for retailers who ‘may seek to take advantage of it’.

“We expect that there will be no uncharacteristic or abnormal retail price increases in the days leading up to, on the day of, or after the reintroduction of the full rate of fuel excise,” the ACCC said.

What the ACCC statements fail to acknowledge is that there was an extraordinary situation that occurred in the days immediately following the excise cut. Many retailers with the higher excise fuel in their tanks booked a financial loss by immediately lowering their retail fuel prices to remain competitive in the face of the ‘next day’ deliveries of lower excise fuel received by some of their competitors.

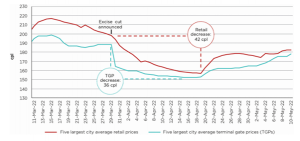

ACAPMA understands (from previous ACCC reporting) that 90% of all service stations had lowered their retail prices to reflect the lower excise two weeks after the excise was cut. Further, the ACCC has publicly noted that the average fuel retail price in Australia’s five capital cities fell by 42cpl (due to the combined excise cut and a lull in global crude oil prices) less than three weeks after the excise cut (see below chart).

Source: www.accc.gov.au (2022).

Source: www.accc.gov.au (2022).

“With just 775 servos (or 10% of all sites) not having lowered their prices after the first two weeks of the excise cut – the majority of which were low volume sites and/or sites in rural areas with little market competition – the ACCC statement that there was an ‘average’ six-week lag for the excise change to be reflected in average retail prices is nonsense”, said Mark.

Perhaps the ACCC might more accurately have stated that around 90% of the Nation’s servos are likely to have adjusted their prices to the excise change, as was observed when the excise was lowered at the end of March 2022.

“Our industry understands that we will be – as we have been for the last 15 years – under ACCC scrutiny during the upcoming transition to the higher excise. But the fact is that the vast majority of the Nation’s fuel retailers did the right thing when the excise was cut and will do the same when it is increased”, said Mark.

“I am confident that our industry will do the right thing when the full fuel excise is restored next week, in accordance with the strong competitive dynamic that continues to characterise the fuel retail market in Australia.

“ACAPMA will therefore not be backward in stridently (and publicly) defending our industry against unfounded price criticism relating to the rate of the fuel price transition in the days and weeks following the restoration of full fuel excise”, concluded Mark.

Fuel Excise Transition – the quick facts

- The previous Morrison Government halved fuel excise (from 44.2cpl to 22.1cpl) at midnight on 30 March 2022, for a period of six months. Fuel Tax credits for non-road transport businesses were similarly halved and the Fuel Tax Credit for road transport businesses (of 17.8cpl) was suspended.

- The discounted fuel excise was increased from 22.1cpl to 23cpl on 1 August 2022 as part of the Australian Government’s six-monthly indexation of fuel taxes. Fuel Tax credits were changed accordingly.

- The rate of fuel excise will increase from the current 23cpl to 46cpl at 12.00am on 29 September 2022.

- Fuel Tax Credits available to non-road transport businesses (i.e. mining agriculture, construction, forestry etc) will increase to 46cpl at the same time as the excise rate changes

- The Fuel Tax Credit for road transport operators will be reintroduced at 12.00am on 29 September 2022, at the rate of 18.8cpl.

ACAPMA