The UK’s food-to-go sector will be worth £23.5 billion by 2022, up from £17.4 billion in 2017, according to IGD, as shoppers’ preference for eating on the move shows no signs of slowing down.

The UK’s food-to-go sector will be worth £23.5 billion by 2022, up from £17.4 billion in 2017, according to IGD, as shoppers’ preference for eating on the move shows no signs of slowing down.

IGD’s food-to-go research splits the market into five segments: food-to-go specialists, quick-service restaurants (QSRs), coffee specialists, convenience and forecourt retailers, and supermarkets and hypermarkets. The organisation’s latest forecasts suggest particularly strong growth among specialist food-to-go retailers, which are set to overtake QSRs to become the biggest part of the market in the next five years.

IGD Senior Insight Manager Gavin Rothwell says as shoppers become more sophisticated in their tastes and demands, so too does the UK’s food-to-go market.

“Across all our five market segments we’re seeing some highly innovative product and menu development, much of this inspired by shopper trends towards health and wellness and global flavours and tastes,” he said. “Many operators are looking to tempt shoppers with ranges tailored to different times of day, while also improving the quality of their fresh food and coffee offers.”

“Food-to-go specialists are really setting the pace on product innovation and range development, as well as expanding quite rapidly outside London, which is why we’re forecasting them to become the biggest part of the food-to-go market by the end of 2022.

“Health and wellness is a particularly big focus for these specialists, with 76 per cent of shoppers satisfied with the choice of healthy options available in-store – higher than any other segment of the food-to-go market.”

Mr Rothwell says convenience and forecourt retailers have spotted a great opportunity in the food-to-go market and are now becoming increasingly active in this area, either through their own ranges or by teaming up with well-known brand names to add credibility.

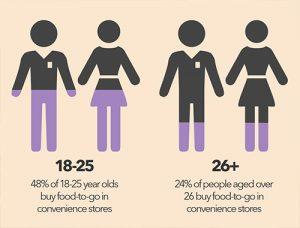

“Younger shoppers are particularly likely to drive growth in these stores, with 18-25 year-olds twice as likely to buy food-to-go in convenience stores compared with their older counterparts,” he said.

“The same goes for supermarkets and hypermarkets, which are increasingly devoting more space in-store to food-to-go. Many are expanding their own ranges, as well as creating new partnerships with suppliers, to introduce more diverse in-store experiences, such as sushi bars and juice bars. With 55 per cent of food-to-go shoppers visiting a supermarket, there’s clearly plenty of opportunity for these stores to perform well in food-to-go.”

IGD expects to see the five market segments become increasingly blurred, as specialists and grocery retailers continue to combine great fresh food-to-go ranges with excellent drinks offers that tick the boxes for shoppers when it comes to quality.