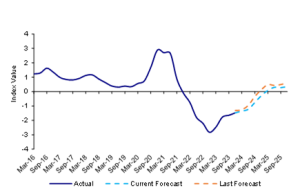

The latest KPMG Australia Retail Health Index (RHI) indicates that a slower than expected Christmas trading period will see a sluggish return to positive health for the retail sector no earlier than mid-2025.

Between the September and December quarters of 2023 the KPMG RHI rose by 0.17 index points, moving from -1.65 to -1.48. While an improvement over the previous quarter, the results still suggest the general health of the retail sector is frail.

KPMG Retail Health Index, Actual & Forecast

Some retailers better off as consumers choose needs over wants

The big winners over Q2 FY24 were clothing and footwear retailers with consumer spending increasing by 28% followed by furnishings and household equipment by 19.1% compared to the September quarter. Strong November sales spike suggested consumers embraced ‘Black Friday’ and ‘Cyber Monday’ sales as they adopted a spend and save approach heading into Christmas.

Household spending on hotels, cafes and restaurants fell by -1.1% over the quarter. This sector traditionally sees a surge of over 8% over the festive season showing consumers are being more selective and factoring in cost-of-living pressures.

KPMG Head of Retail & Consumer James Stewart says, “Household savings rates have now dropped well below their long-term average as consumer dry powder available for spending is redirected to needs vs wants responding to the cost-of-living surge driven by interest rates and the rapid rise of input costs impacting retail prices”.

Immigration remains the saving grace for retailers and the key driver of growth combined with a slight uptick in consumer sentiment which increased from -0.13 to 0.18 and contributes 0.1 index points in the 2023Q4 RHI (up from -0.08 index points in the 2023Q3 RHI).

KPMG Chief Economist Dr Brendan Rynne says, “The positivity associated with the ‘Santa Claus effect’ felt at the start of January 2024 quickly fell off and consumer sentiment is now back down to levels seen at the end of last year.”

Retailers optimistic for the future

The Australian retail sector may be facing some short-term headwinds, but globally there is optimism for the future with retailers looking to capitalise on emerging mega-trends, including AI, in-store technology and the rise of social commerce.

According to KPMG research c.70% of retail leaders believe the adoption of AI will be a game changer for customer experiences well as overhauling retail models impacting supply chain, product development, and demand planning.

There is also accelerated investment in in-store technology by retailers seeking to create a frictionless retail experience for consumers, including just walk out technology and biometric payment solutions such as Amazon Palm Pay which leverage technology to enhance the customer experience.

Mr Stewart says the rapid rise of socially digital retail disruptors will also force local businesses to adapt their offerings and reshape the way they engage consumers.

“If we look at the popularity Shein, it is essentially leveraging social media to drive customer discovery, product development and D2C transactions. Social media is creating a new future for the industry where entertainment and retail are a blended experience for consumers.”