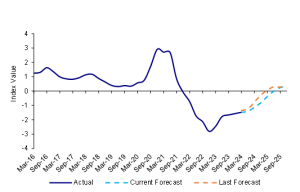

The latest KPMG Australia Retail Health Index (RHI) indicates the road to recovery for Australia’s embattled retail sector has stalled, with positive health not forecast until September 2025.

Between the December quarter 2023 and the March quarter 2024 the KPMG RHI had a rise of just 0.09 index points from -1.57 to -1.48, reflecting a similar small rate of improvement achieved during the final quarter of last year.

The relative profitability of the retail sector is now well below its long-term average, representing 4.7% of total industry profitability compared to its long-term average of 6.4%.

KPMG Retail Health Index, Actual & Forecast

Immigration no longer the saving grace for discretionary retailers

Retail turnover at current prices increased by 0.1% month-on-month between March and April 2024 and recorded no growth on a rolling three-month basis for the same period. Once inflation and immigration are considered, sales activity associated with discretionary spending remains well below levels seen 12 months ago.

This decline in volumes is occurring in a period of extremely high population growth, suggesting spending on an established per household basis is down by approximately 6 to 7% on a year-on-year basis.

KPMG Head of Retail & Consumer James Stewart says, “It’s no surprise that retailers have been suffering at the hands of low levels of consumer confidence but, until now high immigration levels had been papering over the cracks.”

Discretionary retailers take a hit while food remains resilient

Discretionary categories like clothing, footwear and personal accessories and department stores are all experiencing weak, but albeit still positive, growth in nominal sales revenue for the same period, up 0.4% and 0.2% respectively compared to the same time last year.

However, food retailers remain robust as cafes and restaurants and takeaway food retailing saw a 2% increase and general food retailing had a 1.9% increase in nominal spending growth compared to the same three-month reference period in 2023.

Stabilised wages a fleeting relief

The accommodation and food services and retail sectors both recorded a stabilising in annual increases in total hourly rates of pay excluding bonuses, with each sector seeing annual wages growth of 4.4% and 4% respectively in the March quarter 2024.

The stabilising of wages growth across the two sectors continues to reflect softer labour demand, despite employment across the accommodation and food services sector and the retail trade sectors increased by 3.5% and 1.7% respectively between November 2023 and February 2024.

Despite growth of total employment in these two sectors job vacancies recorded a drop of 8000 positions to be filled over the three months to February 2024.

KPMG Chief Economist Dr Brendan Rynne says, “Importantly from a wage growth perspective there are still around 40,000 less people employed across the two sectors than compared to employment levels in the middle of 2023”.

Mr Stewart said despite a stabilised wage environment the recent decision by the Fair Work Commission to increase the minimum wage will put cost pressure back on retailers.

“The 3.75% increase to the minimum wage will lump pressure back on retailers after a brief period of stabilisation,” he said. “The flow on effects to award wages will mean the retail sector will be impacted at a time where sales are slow, and half year results for major retailers have been soft.”

Consumer confidence key to bounce back

Prolonging of current financial pain for many households has continued to weigh heavy on consumer confidence, with the Westpac – Melbourne Institute survey reporting 51% of consumers consider their family finances to be worse than a year ago and only 31% expecting their financial situation to improve in the next year.

Mr Stewart says that some of the Federal Government’s measures in the budget may alleviate some pain and provide a short-term boost for consumers and retailers.

“Cost-of-living relief measures including the stage three tax cuts and $300 electricity will create some household spending breathing room and ultimately provide some confidence to both consumers and retailers,” he said.