Australian retail turnover rose 1.3% in July 2022, the largest increase in four months, according to the Retail Trade figures released today by the Australian Bureau of Statistics (ABS).

The rise in July follows a 0.2% rise in June 2022 and 0.7% rise in May 2022.

ABS Head of Retail Statistics Ben Dorber says: “After slowing growth in recent months, the 1.3% rise in July was the largest since the 1.6% rise in March 2022.

“Turnover rose in five of the six retail industries in July 2022. This shows that, despite cost-of-living pressures, households are continuing to spend.”

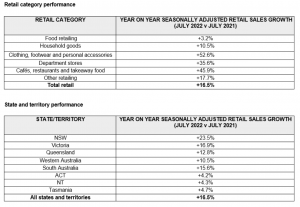

Department stores had the largest growth, up 3.8%, followed by clothing, footwear, and personal accessory retailing (3.3%), cafes, restaurants, and takeaway food services (1.8%), other retailing (1.6%) and food retailing (1.2%).

Household goods retailing declined for the third time in four months, down 1.1% in July 2022.

Turnover increased in Victoria (1.8%), the ACT (1.8%), WA (1.6%), NSW (1.3%), SA (1.2%), the NT (0.7%) and Queensland (0.4%).

Tasmania was the only state where retail turnover declined, down 0.3%. This was the state’s first fall in 2022.

Retail sales continue to strengthen despite cost of living pressures

Australian retail sales continued their record-breaking run in July, with $34.7 billion spent in stores and online – an increase of 16.5% on a year ago and up 1.3% compared to the previous month, according to ABS figures.

Australian Retailers Association CEO Paul Zahra says consumer spending remains strong despite cost of living challenges, but warned sales could soften in the months ahead as household budgets are placed under increased stress.

“It’s pleasing to see retail sales maintain their strength – this is an incredible result considering the inflationary pressures consumers are under at the moment. Confidence remains low, but that hasn’t translated yet into reduced spending with retail sales continuing their record-breaking run,” Mr Zahra said.

“However, the concern is that with inflation yet to peak and the full impact of increased mortgage repayments yet to flow through to household budgets, we may see sales soften in the months ahead.

“The figures should also be treated with caution in their comparisons to a year ago, as we’re now cycling the 2021 Delta lockdowns when businesses in NSW and Victoria were severely restricted. July sales for clothing, footwear and personal accessories, department stores and cafes and restaurants were up significantly compared to 12 months prior, highlighting the impacts on those businesses at this time last year when they had to close their physical stores,” he said.

“We also note that the high sales volumes can also be partially attributed to the higher consumer prices we’re seeing across the economy, particularly in the food industries.

“Father’s Day is coming up on Sunday and the ARA’s forecasts with Roy Morgan show gift spending is down 7.7% compared to last year, with 42% of consumers saying the current cost of living challenges will impact how much they’ll spend.

“So, while sales are strong for now, the concern is that consumers will start to be squeezed when it comes to their discretionary purchases in the run up to Christmas,” Mr Zahra said.