MEDIA RELEASE 05.09.2022

Despite the six-month cut in fuel excise reducing retail petrol prices in the June quarter 2022, the ACCC’s latest quarterly petrol monitoring report shows this could not prevent real (inflation adjusted) retail petrol prices reaching new 14-year highs due to international factors.

Record international prices for crude oil and refined petrol were due to increased demand, production cuts by Russia and the OPEC cartel, and war in Ukraine.

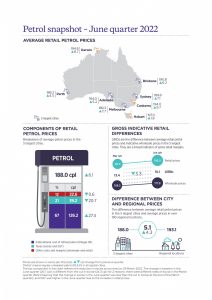

The report shows that June quarter average retail petrol prices in the five largest capital cities were 188.0 cents per litre (cpl), up by 6.1 cpl from the March quarter. This was the sixth consecutive quarter in which prices increased. In real terms, prices in the June quarter were the highest since the September quarter in 2008 (when average prices in 2021-22 dollars were 206.9 cpl).

Retail prices then fell by about 35 cpl in July as international crude oil and refined petrol prices declined due to an increase in supply from oil stockpiles, lockdowns in parts of China and a worsening global economic outlook.

“Motorists experienced savings because of the fuel excise cut at a time of record and rising wholesale prices. The excise cut prevented even higher prices due to international factors, largely driven by the war in Ukraine,” ACCC Chair Gina Cass-Gottlieb said.

“Since late June, average retail petrol prices have come down a lot, in line with decreases in international crude oil and refined petrol prices.”

Reinstatement of full petrol excise

From 29 September 2022, the full fuel excise will be reinstated, translating to an extra 25.3 cpl in taxes. This is made up of an increase in fuel excise of 23.0 cpl, which includes an increase of 0.9 cpl following automatic fuel excise indexation in August, and the associated GST. Wholesalers are expected to pass on this increase to retailers in full, from this date.

Following the excise reintroduction, the ACCC will be monitoring wholesale and retail prices closely and will not hesitate to take action if retailers make misleading statements on price movements or if there is evidence of anti-competitive behaviour (such as price collusion).

“We will shortly be engaging with fuel wholesalers and retailers to say that we do not expect to see uncharacteristic or abnormal wholesale and retail price increases in the days leading up to, and on the day of, or after, the reintroduction of the full rate of fuel excise,” Ms Cass-Gottlieb said.

“Motorists are reminded that prices will continue to fluctuate with changes in international prices and the exchange rate, as well as petrol price cycles in the five major capital cities. Our monitoring and analysis will assess and report on all factors influencing retail prices. The ACCC will continue its weekly reporting to consumers about what is happening to fuel prices and when to find the cheapest fuel.”

“Shopping around and using fuel price apps can help consumers find the cheapest petrol in their area. Our previous research has shown that buying at independent retailers and avoiding the top of the petrol price cycle in the five largest capital cities can save motorists a lot of money,” Ms Cass-Gottlieb said.

The ACCC will closely monitor daily average fuel prices to assess the increases in wholesale and retail prices. It can compel refiners, importers, terminal operators, wholesalers and retailers to provide information relating to fuel prices when necessary. It will also monitor the margins of fuel retailers.

“Petrol stations must not make false and misleading statements to consumers about the reasons for any price increases. We will not hesitate to name retailers should this happen and the ACCC can take appropriate enforcement action,” Ms Cass-Gottlieb said.

Updated information about the monitoring of petrol prices in the lead up to the reintroduction of the full excise, and afterwards, is available on the ACCC website at Monitoring fuel prices following the excise cut. Information about petrol price cycles is also available online, at Petrol price cycles.

Seven-day rolling average retail petrol prices in the five largest cities in nominal terms: 1 January 2020 to 31 July 2022

Source: ACCC calculations based on data from FUEL trac.

Source: ACCC calculations based on data from FUEL trac.

Notes: The shaded area in the chart represents the June quarter 2022. A seven-day rolling average price is the average of the current day’s price and prices on the six previous days.

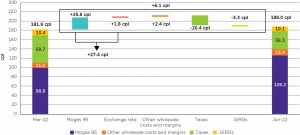

Changes in the components of average retail petrol prices in the five largest cities: March quarter 2022 to June quarter 2022

Source: ACCC calculations based on data from FUELtrac, Argus Media, Ampol, bp, Mobil, Viva Energy, WA FuelWatch, RBA and ATO.

Source: ACCC calculations based on data from FUELtrac, Argus Media, Ampol, bp, Mobil, Viva Energy, WA FuelWatch, RBA and ATO.

Diesel prices

Quarterly average retail diesel prices in the five largest cities were 207.3 cpl in the June quarter, an increase of 21.9 cpl from the March quarter.

Diesel prices were 19.3 cpl higher than average petrol prices in the quarter, due to the international benchmark prices for refined diesel being higher than those for refined petrol. These higher prices were influenced by higher demand due to the post-Covid-19 economic recovery and fewer supplies from Russia influenced by the conflict in Ukraine. Unlike petrol, diesel has broader use in industrial activity and electricity generation.

Background

On 16 December 2019, the Treasurer issued a new direction to the ACCC to monitor the prices, costs and profits relating to the supply of petroleum products in the petroleum industry in Australia and produce a report every quarter. The ACCC monitors retail prices in all capital cities and over 190 regional locations across Australia. This is the 11th quarterly petrol monitoring report under the new direction.

In March 2022, the then Australian Government introduced a six-month fuel excise cut to apply from 30 March to 28 September 2022. It reduced the overall tax paid by 24.3 cpl, being a 22.1 cpl fuel excise cut plus associated GST.

Source: accc.gov.au/media-release/international-oil-prices-drove-petrol-prices-higher-despite-excise-cut.