Daniel Bone

Channel Insights Manager

Daniel Bone is an established insights professional and experienced speaker at conferences in the FMCG industry and senior client engagement. He has more than 15 years of industry experience, bringing to life insights across drinks,food, beauty and household sectors globally. Daniel is responsible for driving IRI’s thought leadership by uncovering the current market truths and future directions for the grocery, convenience, liquor and pharmacy channels in Australia.

About IRI

IRI is a leading provider of big data, predictive analytics and forward-looking insights that help FMCG,OTC healthcare, retailers and media companies to grow their businesses.With the largest repository of purchase, media, social, causal and loyalty data, all integrated on an on- demand cloud-based technology platform, IRI helps to guide its more than 5,000 clients around the world in their quests to remain relentlessly relevant,capture market share,connect with consumers and deliver market-leading growth.

Total P&C industry sales growth accelerated in Q1 2018 driven by the industry’s key in-store growth fixtures.

The end of Q1 this year provides an opportune moment to reflect on the performance of Australia’s P&C channel after a challenging 2017, when the industry was characterised by slower growth of 1.7 per cent (MAT to 31/12/17) and a heavy reliance on just a few areas of merchandise in order to sustain the diminishing growth momentum. Were there any signs of change asof April 2018?

An encouraging but seasonally influenced start to 2018

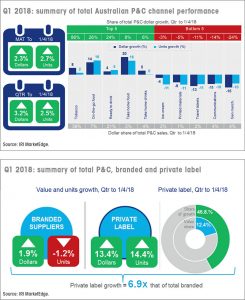

The $5.64 billion P&C industry measured by IRI recorded annual dollar growth of 2.3 per cent (MAT to 1/4/18), propelled by improved quarterly gains of 3.2 per cent. Isolating the timeframe to just the last four weeks of data reveals dollar growth of 7.5 per cent. Such lofty sales increases reflect half of the Easter long weekend falling into Q1 this year (versus mid- April in 2017). This impact cannot be underestimated; the extended hours and inherently convenient location of P&C stores meant that dollar sales during the core Easter and Christmas weeks in 2017 were nine per cent and 16 per cent, respectively, above the typical 52- week average.

We still see a situation of clear winners and losers when adopting a total channel lens. In the 52 weeks to 1/4/18, a majority of the channel’s retail banners recorded declining year-on-year dollar sales – a continuation of the scenario evident in 2017. But Q1 is at least encouraging in terms of what we are seeing from the areas of merchandise that are fundamental in sustaining future industry profits: food, tobacco and beverages.

Private label propels food profits

While private label hotspots are observable across all FMCG channels, P&C stands out for the manner in which retailer-owned labels are driving overall channel performance. Private label accounted for just 12 per cent of IRI’s P&C market read, but 64 per cent of all industry dollar growth.

Despite branded product sales accelerating slightly in Q1 2018 (due to tobacco gains primarily), private label’s rate of growth remains nearly seven times higher than branded in the latest quarter. In both timeframes, private label unit growth has tracked slightly higher than value gains, which is indicative of price def lation having an impact on segments with a higher private label skew (eg, hot drinks, sandwiches and frozen carbonated beverages).

It is no coincidence that the continued double-digit growth in on-the-go food (13.7 per cent) mirrors the trajectory observed in overall private label. The 20.8 per cent increase in private label on-the-go food sales in Q1 2018 was underpinned by retailer-led innovation that saw a 6.3 per cent quarterly spike in category SKUs (up slightly versus the 5.8 per cent year-on-year product count growth). Private label accounted for six of the top 10 growth brands in on-the-go food in Q1 2018.

The annual growth largely sustains the category’s impressive momentum in the full calendar years of 2016 (15.6 per cent, MAT to 1/1/17) and 2017 (14.1 per cent, MAT to 31/12/17). When isolating performance in Q1 2018, it is apparent that growth in the category’s leading segments was broadly in line with the growth rates observed over the past 18 months: sandwiches (16 per cent), hot pastry (8.2 per cent), and fresh cakes (14.6 per cent).

Q1 2018 data shows that take-home food remains the fastest-growing area of food merchandise (20 per cent), continuing on from the trend in 2017. P&C stores are reaping rewards from offering a more versatile range that caters beyond the ‘consume-it-now’ food occasion. Emerging brands such as YouFoodz, which has attracted consistent growth in the Australian market since its founding in 2012, will play a key role in developing what remains a fledgling part of in-store sales.

Beware complacency in convenience food retailing

Despite three years of double-digit growth, the P&C industry must remain mindful of complacency, particularly the select few P&C retailers that are currently optimising the opportunity.

One of the most revered convenient-food retailers globally, the UK’s M&S Simply Food, highlights the challenges of sustaining growth. M&S has been renowned for its high-quality and innovative convenience own-label food offering, which has elevated British consumers’ readiness to embrace petrol forecourt retail for a wider assortment of food products (because they are convenient, but with an enticing aura of being home-made/ professionally prepared).

Even in late 2017, consumer research by the UK’s Which? magazine among 6,800 people established that M&S Simply Food and Little Waitrose were deemed the best convenience propositions (owing to a great variety of fresh products and compelling range).

Woolworths executives were reported to have visited the UK to draw inspiration from the BP Marks & Spencer operation in advance of the initial (and subsequently rejected) BP and Woolworths Petrol deal. BP’s global CEO has also spoken of the “chance to replicate that very successful strategy in Australia”.

But favourable perception does not always convert to purchase intent and in-store sales. Highlighting this, like-for-like M&S food store revenues fell 0.4 per cent in the 13 weeks to December 30, 2017 at a time when many other competing UK retailers had been reporting (inflation-propelled) growth.

So why the change? Other UK supermarkets have closed the quality and convenience gap, and broader competition has arrived from convenience- driven foodservice outlets. All have combined to lessen M&S’ position as the primary ‘go-to’ destination for convenience- driven food missions across day parts and the retailer is arguably falling victim to a trend it was at the forefront of perpetuating: transient and fickle ‘food fashions’ that require a constantly evolving mix of trending products to sustain relevance.

Fortunately the Australian market is comparably less fickle and unforgiving – at least for now. We expect the gap to close in 2018 as a more expansive range of products heightens P&C customer expectations.

Tobacco continues to offset poor non-food performance

Aside from the aforementioned seasonal influences, tobacco performance is the other key reason for the accelerated industry growth observed in Q1 2018. The category recorded dollar growth of 7.5 per cent (influenced by a 5.2 per cent spike in average price per unit), which compares favourably with an annual increase of 5.2 per cent (MAT to 1/4/18). Q1 even brought a rare spike in unit sales (2.1 per cent), which also compares favourably with the one per cent decline observed year on year.

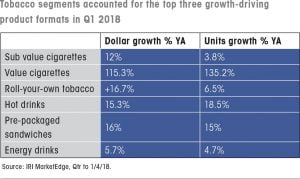

Regardless of whether viewed over a full 52 weeks, or just Q1 2018, tobacco accounted for the industry’s top three growth product segments. Tobacco also accounted for six of the industry’s top seven growth- driving brands. No wonder the category significantly overindexed from a growth perspective in Q1, accounting for 86.2 per cent share of dollar growth versus 38.9 per cent share of industry dollar sales.

Outside of the tobacco fixture, we see a continuation of lost sales and lost relevance in the non-food domain. Sales trends in Q1 2018 suggest that double- digit declines in travel tickets (13 per cent) and communications (10.7 per cent) merchandise will persist throughout the year, and that general merchandise performance (-14.6 per cent) will worsen further.

Beverage sales get an energy boost

Ready to drink (RTD) beverages recorded improved dollar growth in Q1 2018 (3.7 per cent) in light of sustained double-digit increases in hot drinks sales (15.3 per cent) and improved performance from energy drinks (5.7 per cent) and carbonated soft drinks (4.1 per cent).

The hot drinks segment has accounted for the majority share of total category dollar growth for at least two years. As such, it is encouraging for industry players jostling for position among the other beverage formats that the dollar growth contribution derived from hot drinks reduced to 44 per cent in Q1. Energy drinks generated one- third of the category’s growth, underpinned by improved Red Bull performance (seven per cent), and the continued positive momentum behind recent V brand innovations (notably V Bling and V Pure).

The carbonates segment has been boosted by the continued growth of the zero-sugar cola propositions. Pepsi Max dollar sales were up 9.2 per cent in Q1 2018, which is comparable to the strong performance seen over the full 12-month period (10.6 per cent). But Coca Cola No Sugar has also (re)emerged as a bright spot, delivering incremental growth after factoring in the lost sales from the Coca Cola Zero sub-brand that it superseded. The segment has also been bolstered by Coca-Cola Raspberry, which is claimed to contain 25 per cent less sugar than Classic Coke, and emerged as the sixth largest growth-generating SKU across the category in Q1.

We continue to see price deflation having an impact on the RTD beverage category, with average unit prices down 1.3 per cent in Q1 2018. That said, the decline was less pronounced than over the full 52 weeks to 1/4/18 (3.4 per cent). Price deflation has been particularly pronounced in the flavoured carbonated beverages segment for the past two years, but also observable in dedicated iced coffee (3.7 per cent), water (2.4 per cent) and flavoured milk (one per cent) in Q1 2018. As the year progresses we are likely to see some inflation creep back into the category as the influence of the NSW container deposit scheme hits the packaged segments.

‘On-trend’ health themed innovation shapes sales and channel perception outcomes

Another brand extension delivering incremental growth is Oak Plus – a winner of BP’s New Product of the Year Award, with the retailer and supplier having partnered effectively to allocate premium positioning in both impulse and home-base locations. Oak Plus taps into what has become a pertinent global health trend in recent years: convenient and high- quality protein-rich formulations that entice both athletes and everyday lifestyle needs. Equally important as the material growth impact of Oak Plus has been

the ongoing strength of the conventional Oak offering, of which annual sales increased by 10.2 per cent and quarterly sales by 8.2 per cent.

It was also encouraging to see continued growth of kombucha, a format that has become synonymous with consumer demand for less sugar and specific health functionality. In particular, the Remedy brand, which recently accepted a minority investment from Lion Dairy & Drinks, ranked fifth after V Bling in terms of dollar growth contribution to RTD sales in Q1 2018.

Having already made a mark on soft-drink sales in on-premise establishments, boutique stores and more recently in grocery, it was only a matter of time before P&C retailers embraced kombucha. Doing so taps into the sales opportunity, but also symbolically demonstrates an ever-evolving product mix that delivers greater choice. It all aligns with the industry imperative of appealing to the core blue-collar males, but also enticing other demographics driving contemporary food and beverage trends.

Why always last in the innovation diffusion process?

It often it seems that innovation trickles through different channels in a broadly similar fashion: starting in health food stores, then moving into cafés, then to supermarkets, and then to P&C. At a time when there is an ongoing need to disassociate the notion of a stodgy petrol forecourt from a compelling in-store food and beverage range, the industry is incentivised to embrace its unique advantage of being able to spotlight new and interesting products for consumers.

After all, 61 per cent of Australian households surveyed like to try new products and brands, according to IRI’s Shopper Panel psychographics research. It is a sentiment that P&C channel operators must collectively tap into in order to sustain the encouraging beginning we have seen in 2018.