The latest ACCC Petrol Monitoring Report has been released and has identified that in the midst of the pressurised cost of living situation average retail petrol prices fell over the March quarter with diesel prices falling a significant 10% between the March quarter and the December quarter. Diesel prices were significantly down, petrol prices were less volatile and down slightly overall and the GIRD was also down below pre pandemic levels.

The ACCC monitors closely the wholesale and retail prices of fuel products in Australia, and the quarterly reports place that price information into a context that examines the national and international economic conditions, supply chain costs and other factors to provide commentary on the functionality and competitive health of the industry.

The global demand driven diesel increases, brought on by the Russian invasion of Ukraine in February 2022 has been a key defining characteristic of prices for more than a year. While that pressure continues increased Chinese diesel exports, an increase in US diesel stocks and reduced demand throughout Europe as a milder winter than anticipated was seen have all combined to see the international diesel market stabilise over the quarter.

The global demand driven diesel increases, brought on by the Russian invasion of Ukraine in February 2022 has been a key defining characteristic of prices for more than a year. While that pressure continues increased Chinese diesel exports, an increase in US diesel stocks and reduced demand throughout Europe as a milder winter than anticipated was seen have all combined to see the international diesel market stabilise over the quarter.

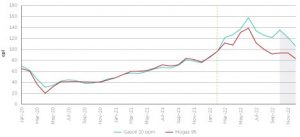

Monthly average Gasoil 10 ppm and Mogas 95 prices in nominal terms: April 2021 to March 2023 – cpl

Source: ACCC calculations based on data from Argus Media and the Reserve Bank of Australia.

Source: ACCC calculations based on data from Argus Media and the Reserve Bank of Australia.

Notes: The shaded area in the chart represents the March quarter 2023.

The green dotted line indicates when the Russian invasion of Ukraine began (20 February 2022).

Gasoil 10 ppm is the international diesel benchmark and Mogas 95 is the international petrol benchmark.

“We are pleased that developments in international diesel markets have led to a decrease in the retail price of diesel, a crucial input to many parts of the economy,” ACCC Commissioner Anna Brakey said.

In addition to diesel being significantly down over the quarter retail petrol prices were stable after a period of intense fluctuation in the previous quarter.

“Retail petrol prices in the five largest cities were less volatile in the March quarter, following significant volatility in 2022 due to fluctuating international crude oil and refined petrol prices, and the temporary cut, and subsequent restoration, in fuel excise”, Ms Brakey said.

While quarterly average retail petrol prices across the five largest cities fell slightly, by 0.5 cpl, to 182.2 cpl, they fell by 3.2 cpl in Perth (to 176.6 cpl) and 0.9 cpl in Melbourne (to 184.3 cpl) and rose by 1.5 cpl in Brisbane (to 186.4 cpl). Prices in Sydney rose slightly (up 0.5 cpl) while Adelaide prices recorded a slight drop (down by 0.3 cpl) in the quarter.

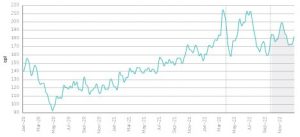

The following chart shows movements in seven-day rolling average retail petrol prices in the five largest cities from 1 April 2021 to 31 March 2023. The chart also indicates when fuel excise was cut from 30 March 2022, and when it was restored from 29 September 2022.

Seven-day rolling average retail petrol prices in the five largest cities in nominal terms: 1 April 2021 to 31 March 2023 – cpl

Source: ACCC calculations based on data from FUELtrac.

Source: ACCC calculations based on data from FUELtrac.

Notes: The shaded area in the chart represents the March quarter 2023.

The 2 dotted lines indicate the cut in fuel excise from 30 March 2022 and the restoration of full excise from 29 September 2022.

A 7-day rolling average price is the average of the current day’s price and prices on the 6 previous days.

Retail petrol prices also decreased in the smaller capital cities. On average, petrol prices in Hobart were 4.2 cpl cheaper than in the December quarter, while Darwin prices dropped by 3.2 cpl and Canberra prices were down by 2.0 cpl.

Retail petrol prices in over 190 regional locations in the March quarter averaged 183.1 cpl. The gap between average prices in regional locations and the average of the five largest cities narrowed by 3.4 cpl to only 0.9 cpl. In regional areas in New South Wales, Victoria and Queensland, average petrol prices were below prices in the respective capitals.

Diesel prices were significantly down, petrol prices were less volatile and down slightly overall and the GIRD was also down, below pre pandemic levels.

GIRD are the difference between average retail petrol prices and average wholesale prices, and broadly indicate a measure of movement in gross retail margins. Because the GIRD does not account for retail operating costs including rent, electricity, wages, maintenance, compliance and delivery the GRID must not be confused with profit. GIRD is not analogous for and must not be interpreted as actual retail profits.

The GIRD (Gross indicative retail differences) in the five largest cities declined by 0.5 cpl to 11.4 cpl in the quarter, and were 12.2 cpl, below pre-pandemic levels over the year to March 2023. In real (inflation adjusted) terms, 12-month average GIRD from March 2017 to December 2019 were between 13.6 cpl and 14.6 cpl.

“Less volatile petrol prices in the five largest cities, and declines in prices in most regional locations have been good news for many motorists in the March quarter,” Ms Brakey said.

More information

For a copy of the ACCC March Quarter 2023 Petrol Price Monitoring Report, see accc.gov.au/system/files/Report%20on%20the%20Australian%20petroleum%20market%20-%20March%20quarter%202023.pdf.

Elisha Radwanowski BCom (HRM & IR)

ACAPMA

Source: ACCC reports fuel price drops are good news for consumers – ACAPMAg.